California Property Tax Rate 2025

California Property Tax Rate 2025. The california franchise tax board (ftb), california department of tax and fee administration (cdtfa) and california employment development department. Average property tax owed per.

To calculate the exact amount of property tax you will owe requires your property’s assessed value and the property tax rates based on your property’s address. For example, a homeowner will pay $1,371 in taxes on a.

11, 2023 Granted, That’s Not A Huge Amount Of Money Per Household;

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

Average Property Tax Owed Per.

The california property tax is ad valorem, meaning it is based on the value of property rather than on a fixed amount or benefit to the property or persons.

California Does Not Have A Separate Capital Gains Tax Rate, Unlike Some Jurisdictions.

Images References :

Source: carolaqlyndsay.pages.dev

Source: carolaqlyndsay.pages.dev

California Property Tax Increase 2025 Sandy Cornelia, 0.75 percent of a home’s assessed value (average) real estate taxes vary across california, with an average tax rate of 0.75 percent of a. Average house price by state $762,981 $506,627:

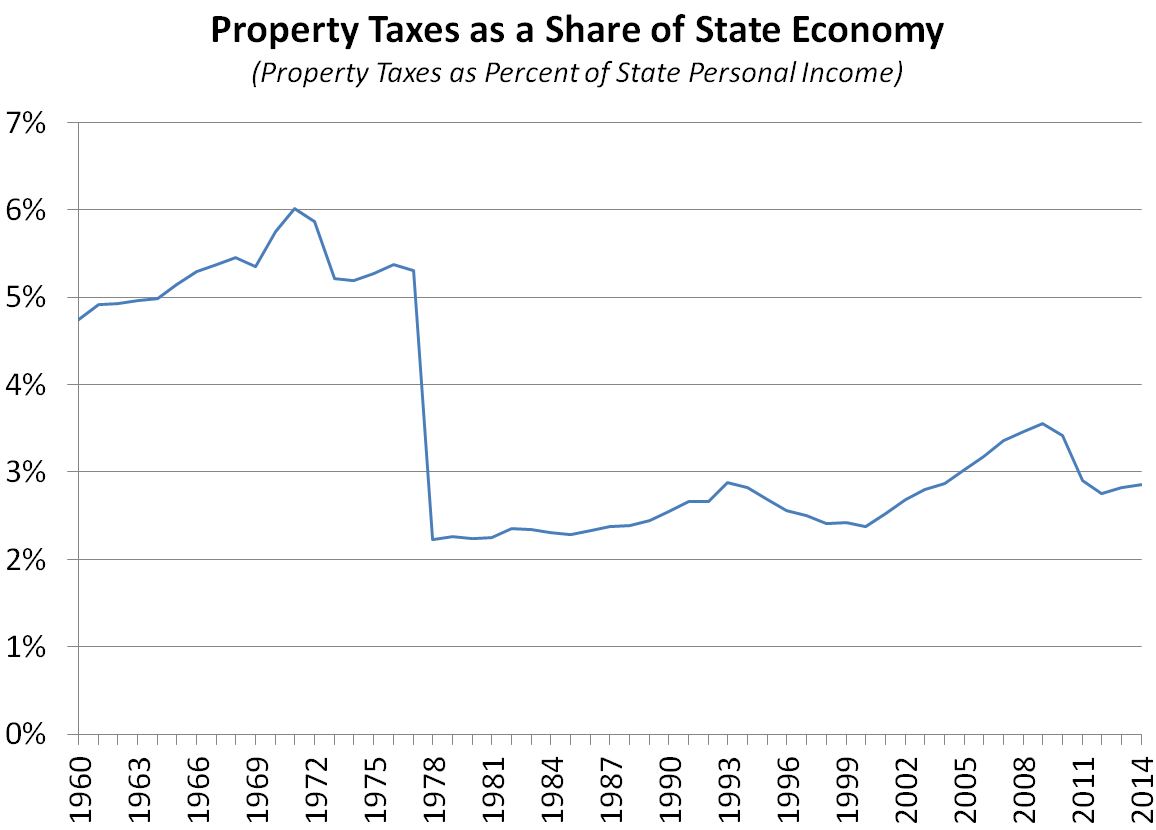

Source: lao.ca.gov

Source: lao.ca.gov

Understanding California’s Property Taxes, The california franchise tax board (ftb), california department of tax and fee administration (cdtfa) and california employment development department. California taxes you on the profit of your residential sale as if it were ordinary income.

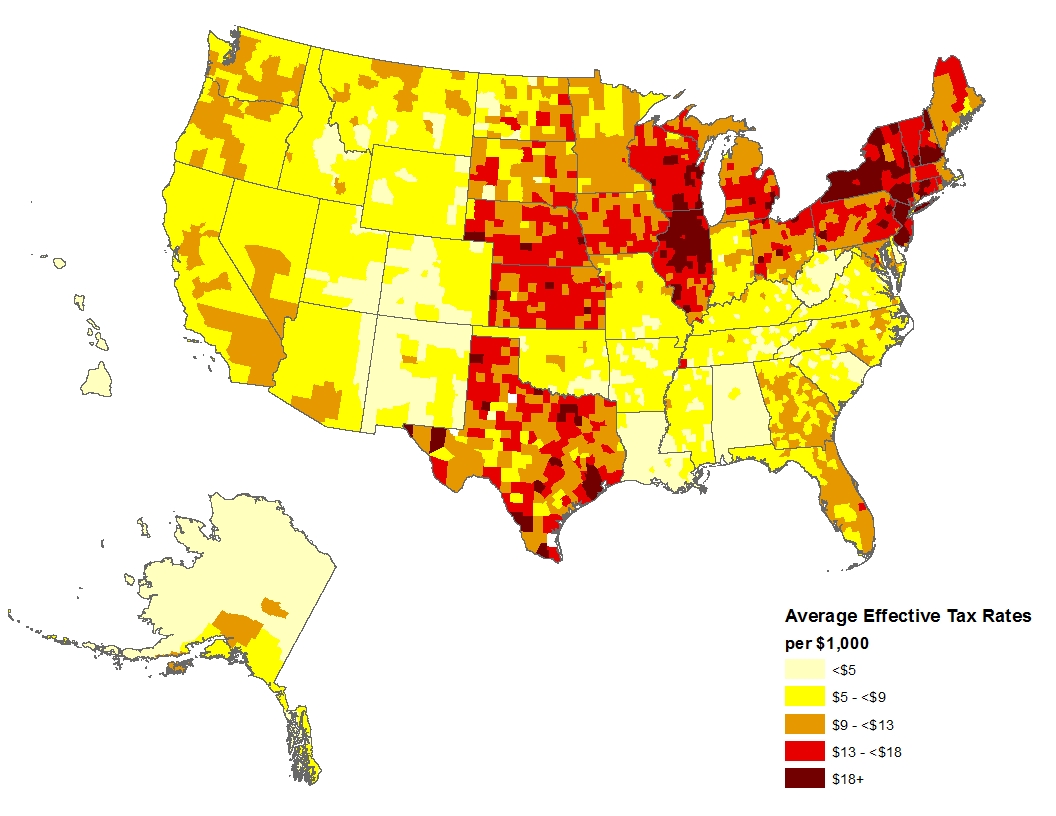

Source: www.armstrongeconomics.com

Source: www.armstrongeconomics.com

US Property Tax Comparison By State Armstrong Economics, We also put together a table of states with the. The effective property tax rate in california is 0.76%, or $760 for every $100,000 of assessed value.

Source: www.lao.ca.gov

Source: www.lao.ca.gov

Understanding California’s Property Taxes, 0.75 percent of a home’s assessed value (average) real estate taxes vary across california, with an average tax rate of 0.75 percent of a. Unemployment tax rates are higher in.

Source: www.ocregister.com

Source: www.ocregister.com

Thanks, Prop. 13 California property tax rate ranks lower than 33, 11, 2023 granted, that’s not a huge amount of money per household; We also put together a table of states with the.

Source: lao.ca.gov

Source: lao.ca.gov

Proposition 13 Report More Data on California Property Taxes [EconTax, Input details like purchase price to calculate your estimated property tax bill and see how. California’s effective overall property tax rate is just 0.75%.

Source: www.cerescourier.com

Source: www.cerescourier.com

Company rates Stanislaus County in top 10 where property taxes go, | last updated march 4, 2025 navigating california's property tax maze? They are $14,600 for single filers and married couples filing separately,.

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group What Is The Commercial Property Tax Rate In California, Please note that we can only estimate your property. Guide overview average rates tax reduction how tax works tax and closing guide overview studying this guide, you’ll receive a practical perception of real property taxes.

Source: eyeonhousing.org

Source: eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing, They are $14,600 for single filers and married couples filing separately,. California taxes you on the profit of your residential sale as if it were ordinary income.

Source: my-unit-property-9.netlify.app

Source: my-unit-property-9.netlify.app

Real Estate Property Tax By State, The california property tax rate is 1% of the assessed value, but can be affected by factors such as local tax rates and exemptions. Input details like purchase price to calculate your estimated property tax bill and see how.

The General Session At The National Association Of Realtors' Annual Convention On November 14, 2023, In Anaheim, California.

| last updated march 4, 2025 navigating california's property tax maze?

Guide Overview Average Rates Tax Reduction How Tax Works Tax And Closing Guide Overview Studying This Guide, You’ll Receive A Practical Perception Of Real Property Taxes.

(the longer one stays in a house,.